Is the Solar Tax Credit Going Away? Here’s What You Need to Know

Alex Neverov, Owner of A&G Electric

For the past two decades, Alex has been at the forefront of the solar energy revolution in the state, making waves in the industry with his passion, professionalism, and unwavering commitment to providing top-notch solar panel installation and services. Join us as we delve into the inspiring journey of a true solar professional who has illuminated countless homes and businesses with clean, renewable energy.

The federal solar tax credit is making headlines again, and not for the reasons we’d hoped. A new bill could bring this clean energy incentive to an early end.

Since the Inflation Reduction Act (IRA) passed under the Biden administration, renewable energy federal tax credits have helped millions of Americans go solar. These credits were designed to make things more affordable, especially for businesses and homeowners looking to cut energy costs.

And they’ve worked, as reported in the U.S. Treasury Department report. In 2023 alone, over 3.4 million families saved a total of $8.4 billion on clean energy upgrades, from solar panels to battery storage and EV car chargers.

Here’s what’s changing, what it means for you, and how to make the most of the current incentives while they last.

Why the Federal Solar Tax Credit Might Be Ending Soon

The federal solar tax credit, also known as the ITC solar tax credit or the residential clean energy credit, is under review. A new bill in Congress could eliminate the solar tax write off.

Here’s what you need to know if you’re wondering is the solar tax credit going away, and how to make the most of it while it’s still here.

Understanding the “One Big Beautiful Bill Act”

In May 2025, the House of Representatives passed the “One Big Beautiful Bill Act”. The goal of this bill is to reduce federal spending and reallocate funds to other national priorities.

One of the bill’s most impactful provisions is the proposal to end federal tax credits for solar after 2025. If it becomes law, the renewable energy federal tax credits could be cut off years before their planned phase-down through 2034 under the Inflation Reduction Act (IRA).

Why Are Lawmakers Proposing the End of the Tax Credit

The House wants to reshape the budget and prioritize other goals. Supporters of the bill argue that:

- The solar industry has matured and is less dependent on subsidies

- The country needs to reduce federal spending and control the deficit

- The funds could be reallocated to other priorities, like defense or tax relief

These arguments reflect a broader effort to roll back the renewable energy federal tax credit introduced under the Inflation Reduction Act (IRA).

What Happens If the Federal Solar Tax Credit Expiration Comes Early

If the bill passes, the 30% credit could end after 2025. This would significantly increase out-of-pocket costs for solar systems and battery storage, making clean energy less accessible to many. For example, a $24,000 solar system could cost an extra $7,200 without the credit.

Clean energy advocates warn this could:

- Make solar less affordable for homeowners and businesses

- Slow down the adoption of battery storage and other energy upgrades

- Create uncertainty in the market and risk job losses in the solar sector

While the outcome of the bill is still undecided, its passage would reshape how people and businesses invest in solar moving forward.

What’s Next for the Solar Tax Credit? Key Dates to Watch

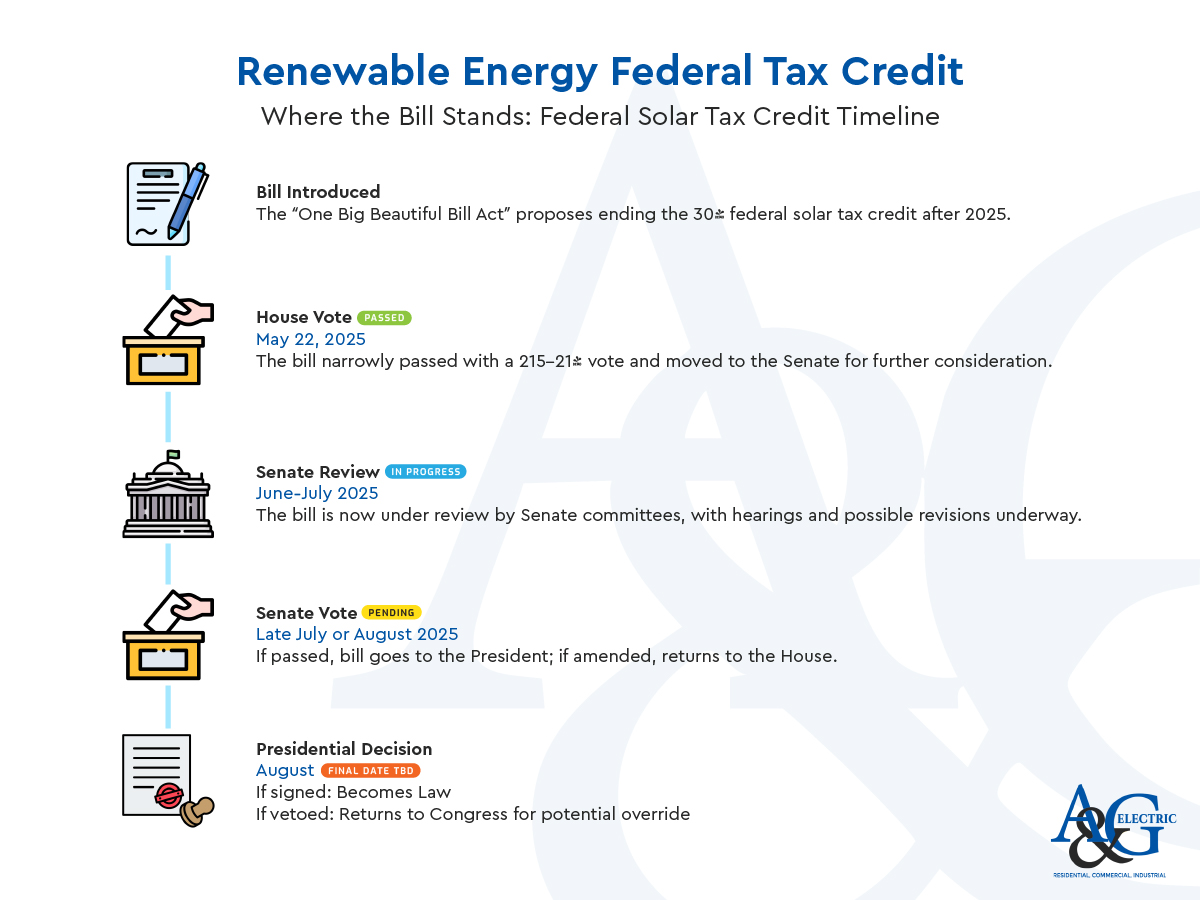

The federal solar tax credit’s future depends on what happens next in Congress. The bill passed the House on May 22, 2025, with a tight 215-214 vote.

It’s now under review with the Senate committees, including Finance and Budget. They are aiming to begin with hearings or revisions as early as June or July 2025, with a possible full Senate vote before August.

If the Senate approves the bill as-is, it will move to the President’s desk. At that point, the President can either sign it into law or veto it.

If the Senate makes changes, the bill must return to the House for another vote. If both chambers agree on the same version, it can then move forward to the President.

For now, the 30% solar tax credit remains active, but the outcome of the next few months will determine whether that benefit continues beyond 2025.

How the Solar Tax Credit Changes Affect California Homes and Businesses

The proposed changes to the federal solar tax credit could impact how California businesses and homeowners plan their energy projects, especially when it comes to budgets and long-term returns.

If the solar tax credit expiration moves forward, many may lose access to a benefit that has helped make clean energy more affordable for years.

While California incentives like SGIP, the solar property tax exclusion, and NEM 3.0 are still in place, their impact is most powerful when paired with the current federal benefits.

For contractors, commercial property owners, and off-grid clients, this is a window to lock in maximum savings, especially through the business solar tax credit before the policy landscape shifts. The smartest move? Take action while both federal and state programs are still working together to support clean energy projects.

California Incentives Still Available in 2025

Even with uncertainty around the federal solar tax credit, California’s state-level tax incentives for solar are still available. These programs offer additional support on their own, but their value increases when combined with the federal solar tax credit, which is why now is the ideal time to act.

Here are three key incentives available in 2025:

🔋 Self-Generation Incentive Program (SGIP)

SGIP is one of California’s most well-known tax incentives for solar with battery storage. It provides rebates for adding batteries to your system, a smart way to boost energy independence while still claiming solar tax credit at the federal level.

These rebates are especially helpful in wildfire-prone or outage-heavy areas. Depending on your system size and location, you could qualify for thousands through this federal solar rebate program and its state-level counterpart.

🏠 Solar Property Tax Exclusion

This tax incentive for solar ensures your property taxes won’t go up just because you install a solar system. The solar property tax exclusion applies to both residential and business solar tax credit users, protecting you from reassessment and offering long-term savings.

This incentive is active through January 1, 2027, but pairing it with the ITC solar tax credit can increase your return.

⚡ Net Energy Metering (NEM 3.0)

Under NEM 3.0, you can still earn credits for excess solar energy sent back to the grid. While the export rates are lower than in past years, combining solar with battery storage helps you keep more of what you produce.

For those exploring federal tax credits for solar and state savings, this policy is a critical piece of the equation.

How to Claim the Federal Solar Tax Credit Before It Expires

With the federal solar tax credit potentially ending this year, now’s the time to understand the process of claiming solar tax credit, and how to make sure you qualify before the deadline.

In this section, we’ll guide you through the steps to secure your solar tax write off, avoid delays, and take full advantage of the federal incentives for solar panels while they’re still available.

Step 1: Get Your System Up and Running by December 31, 2025

To qualify, your system needs to be fully installed and placed in service by the end of 2025. That means:

- Permits are approved

- Equipment is installed and operational

- Final utility sign-off or interconnection approval is complete

It’s not enough to just have the system installed. You also need final approval, utility sign-off, and everything up and running.

Step 2: Keep Your Paperwork Organized

You’ll need to document every part of the project to support your claim. That includes:

- Signed contracts and proof you own the system (leases don’t qualify)

- Itemized invoices for equipment and labor

- Utility approval or certificate of completion

- Any rebate or incentive paperwork from your city or state

Working with experienced renewable energy consultants like A&G Electric means you won’t have to worry about missing documents or deadlines. We help our clients keep everything organized so claiming solar tax credit is smooth and stress-free process.

Step 3: File IRS Form 5695 with Your Taxes

To claim the credit, you’ll need to fill out IRS Form 5695. This gets submitted with your federal tax return for the year your system was placed in service. This form lets you apply the credit, up to 30% of your total system cost, including solar panels, inverters, and battery storage.

If you’re combining other incentives or filing under the business solar tax credit, the details can vary a bit. That’s why it helps to work with a tax professional, but the process is very doable when you’re prepared.

Frequently Asked Questions on Solar Tax Credit Going Away

What is the federal solar tax credit?

The federal solar tax credit, or Residential Clean Energy Credit, gives you 30% off the cost of solar panels, battery storage, or solar water heaters. It lowers your federal taxes if you own the system and install it by 2025.

Is the federal solar tax credit going away?

A new bill, the “One Big Beautiful Bill Act,” could end the federal solar tax credit after December 31, 2025. The Senate is reviewing it, so the outcome is unclear. Act now with A&G Electric to secure your savings.

Is solar tax deductible?

The federal solar tax credit isn’t a deduction but a dollar-for-dollar reduction of your tax bill. You can claim 30% of your system’s cost, like $7,200 on a $24,000 project. A&G Electric provides the paperwork you need.

Will projects built in 2025 be eligible for the tax credit

Yes, solar projects completed and operational by December 31, 2025, qualify for the 30% federal solar tax credit. Start early with A&G Electric to meet the deadline. A tax professional can confirm your eligibility.

What is NEM 3.0 in California?

NEM 3.0 is California’s updated solar policy that lowers export rates, encourages battery storage, and aligns with clean energy goals.

What are the rates for NEM 3.0 in California?

NEM 3.0 rates in California pay about $0.05–$0.08 per kWh for excess solar energy sent to the grid, a 75% drop from NEM 2.0’s $0.23–$0.35. Rates vary by hour, day, and utility (PG&E, SCE, SDG&E), with higher payouts during peak evening hours.

Will California pay for my solar panels?

Incentive programs and tax credits can offset costs but won’t cover full expenses.

How do I get free solar panels in California?

Look into programs like LIWP or SOMAH for eligible low-income properties.

How does A&G Electric assist businesses with solar tax credit?

We design tailored systems, guide you through incentives, and ensure compliance with the solar tax credit.

Can A&G help design a solar system tailored to my needs?

Yes, we create customized systems to meet your energy and budget requirements.

Claim Your Solar Tax Credit Before It’s Gone

Don’t miss your chance to take advantage of the 30% Solar Tax Credit and maximize your clean energy savings.

At A&G Electric, we guide California homeowners and businesses throughout the entire process. We offer complete solar services and support you with all the paperwork needed to claim your credit.

Still wondering is the solar tax credit going away? Don’t wait for legislation to decide for you.

We’ll make sure you have everything ready for claiming solar tax credit before the deadline hits.

If you have any questions or need assistance with your solar journey, don’t hesitate to reach out to us 24/7. Whether you’re interested in a solar installation, have inquiries about maintenance, or simply want to explore your options, our team of experts is here to help.

Request a free, no-obligation quote today and start saving on your energy bills while reducing your carbon footprint. Together, let’s make a brighter and more sustainable future with solar energy!

Do you help from a solar or commercial electrical expert?

We proudly offer electrical repair and service options. Give us a call today to schedule a free service estimate!